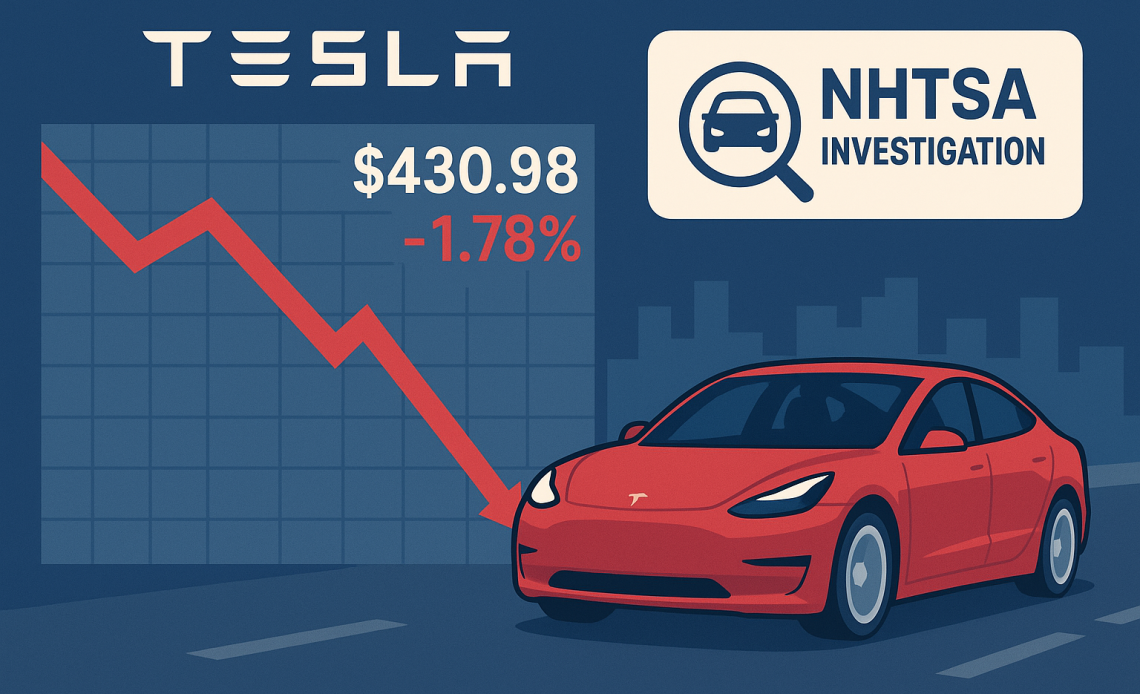

Tesla stock fell early Thursday after the US National Highway Traffic Safety Administration (NHTSA) opened an investigation into the company’s Full Self-Driving (FSD) driver-assistance technology, potentially affecting millions of vehicles.

The stock was down 1.78% at $430.98 in early trading, while broader US equity indices were largely unchanged.

The latest probe comes as Tesla continues to expand its self-driving and AI initiatives, including a robo-taxi service launched in Austin, Texas, in June.

Despite Thursday’s pullback, Tesla stock remains up roughly 36% since that launch, bolstered by growing investor enthusiasm for its artificial intelligence capabilities.

NHTSA investigates reports of traffic violations by Tesla cars

The NHTSA said it is examining reports of Tesla vehicles running red lights and committing other traffic violations while operating under the FSD system.

The agency said it knows of around 58 examples, including cases of vehicles travelling in the wrong direction on roads.

According to an NHTSA filing, the preliminary evaluation covers an estimated 2.9 million Tesla vehicles.

The expanded probe deepens US regulators’ scrutiny of Tesla’s driver-assistance technology, adding to ongoing investigations into issues related to its doors, Autopilot system, and crash reporting practices.

The NHTSA said last year it was also examining whether Tesla’s Full Self-Driving (FSD) software can properly detect and respond to reduced visibility conditions such as fog.

For NHTSA, such investigations can precede recalls, though these typically involve software fixes or component replacements rather than pulling cars off the road.

Analysts maintain bullish outlook

Despite the investigation, analysts remain broadly optimistic about Tesla’s prospects.

TD Cowen reiterated its “Buy” rating on the stock, raising its price target to $509 from $374.

Wedbush analyst Daniel Ives said he was “relatively disappointed” with the pricing and features of Tesla’s newly launched lower-cost electric vehicles but maintained his “Buy” rating, setting a Street-high target of $600 — implying roughly 37% upside from current levels.

Ives said the introduction of the cheaper EV models, despite lukewarm investor reaction, marked an important strategic step toward restoring Tesla’s quarterly delivery pace to 500,000 units.

On October 7, Tesla unveiled two lower-cost electric vehicles aimed at offsetting the impact of the expiration of the federal EV tax credit.

The new version of the Model Y SUV is priced at $39,990, while the updated Model 3 sedan starts at $36,990.

However, Ives and other analysts noted that the roughly $5,000 price reduction offered limited differentiation from previous models.

Shares of the company fell more than 4% following the announcement.

Ives characterised the move as a tactical pricing adjustment rather than a genuine product catalyst, suggesting the company’s strategy now leans on driving volume over introducing major innovations.

The post Why Tesla stock is sliding around 2% on Thursday appeared first on Invezz